In the context of commercial real estate, a finance lease can be used by businesses to acquire the use of property for an extended period, typically covering a significant portion of the building’s useful life. Tango Lease gives you a streamlined, fully compliant process for all your lease accounting and administration needs. Our software assists with the calculations, creates accounting schedules, auto-generates journal entries, and helps you account for every component of every lease using current standards, including ASC 842, GASB 87, and IFRS 16. Navigating the intricate system of accounting standards, terminology, definitions, and calculations that apply to your organization is time-consuming, but there’s an easier way. So if that two-ton truck with an economic life of six years was leased in a new lease term after it had already been in operation for five years, then this criterion would not apply to qualify the lease as a finance lease. So if, for example, a new two-ton truck has an estimated economic life of six years, and an organization leases it for five years, then it would most likely be considered a finance lease.

- Equipment leasing involves multiple types of leases, but the two primary classifications include operating leases and capital leases.

- Therefore, increasing capital lease liability would increase all debt-related ratios and adversely impact the lessee.

- So if that two-ton truck with an economic life of six years was leased in a new lease term after it had already been in operation for five years, then this criterion would not apply to qualify the lease as a finance lease.

- Due to capital leases being counted as debt, they depreciate over time and incur interest expense.

- On January 1, 2022, Company XYZ signed an eight-year lease agreement for equipment.

The increase in reported debt could affect various debt financial ratios and possibly impact the company’s ability to qualify for more business loan options. Suppose you are leasing a forklift that costs $42,000 and will be used for moving materials in your warehouse. A lessee can claim depreciation deductions on the income statement, reducing taxable income. On the other hand, a business that prefers to make lower monthly payments may opt for a 10% buyout option, even if it requires a higher payment at the end. For lessees that aren’t entirely certain they want to purchase the asset, the 10% alternative gives them the option to walk away from the deal and not have to make a large balloon payment at the end.

Create a Free Account and Ask Any Financial Question

There is no ownership risk and payments are considered to be operating expenses and tax-deductible. Finally, the risks and benefits remain with the lessor as the lessee is only liable for the maintenance costs. The capital lease payment – the outflow recorded on the cash flow statement – equals the difference between the annual lease payment and the interest expense payment.

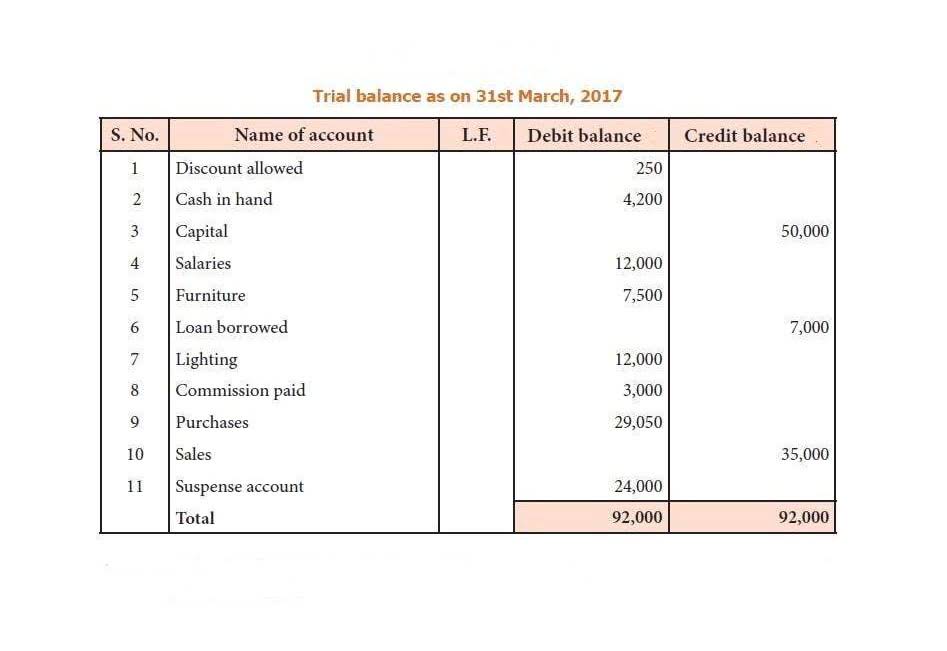

The lease liability account is reduced annually by an amount equivalent to the finance lease’s interest expense, and lastly, the equipment account is reduced by the difference between the lease expense and the lease liability change. This last quantity is a plug to get our debits and credits equal, and these amounts will sum up to the lease liability balance over the lease term. The liability for the lease is recorded on the company’s balance sheet as the market value of the leased asset. Lease payments are recorded on the income statement as a combination of principal and interest expenses.

What is the Accounting for Capital Leases?

It is a type of loan contract, and therefore capital lease liability is considered long-term debt for the lessee. Effectively, no impact to the income statement also means no impact to EBITDA. However, situations may occur where leases classified as operating under ASC 840 may be considered finance leases under ASC 842 as a result of the additional classification criteria, and vice versa.

In general, the company you lease from will ask you for an instrument quote from the manufacturer, along with specific financial documentation that helps them with underwriting. capital lease vs operating lease If any party fails to give this notice, the other party will end up paying the penalty. Cancellation refers to terminating the lease contract in the middle of the lease term.

Ownership transfer

Rather than digging through a filing cabinet or Dropbox to understand the details of each lease, our platform offers instant access to any date, dollar, or important information that may be in that document. And it can be used for contracts, franchise agreements, permits, and any other important documents that are related to your locations. And it starts at just $6 a month per location.Let us show you how we can make lease management a piece of cake. Fair value refers to the price at which an asset would be sold according to the market rates at the date of lease commencement. To determine the fair value of an asset, ASC 820 offers a hierarchy of inputs, with each subsequent level to be used only if inputs from the previous levels are unavailable. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Comentarios recientes